PROJECT

Transforming Credit Access

DESIGNER

Hugo Garduño

Product Designer who enjoys relaxing outside his world and thinking about how there is nothing new under the sun.

Product Designer who enjoys relaxing outside his world and thinking about how there is nothing new under the sun.

OVERVIEW

This fintech is a company that specializes in providing online lending solutions. Their platform includes a BNPL (Buy Now, Pay Later) model, mainly targeting people who don’t have access to traditional banking services. By using digital technology, they aim to make financial services more inclusive and accessible, helping underserved individuals manage their financial needs with ease.

DISCOVERY PHASE

Context

The company identified challenges in its existing Credit Line Increase Policy (CLIP) program in their BNPL model, including lack of transparency, usability issues, and limited user understanding. These issues reduced user engagement and satisfaction, which impacted the company’s long-term growth and customer retention.

As a Product Designer, I collaborated with a research lead to identify key issues in the CLIP program through data analysis (data, NPS, survey) and stakeholder interviews.

The company identified challenges in its existing Credit Line Increase Policy (CLIP) program in their BNPL model, including lack of transparency, usability issues, and limited user understanding. These issues reduced user engagement and satisfaction, which impacted the company’s long-term growth and customer retention.

As a Product Designer, I collaborated with a research lead to identify key issues in the CLIP program through data analysis (data, NPS, survey) and stakeholder interviews.

‧ ‧ ‧

Discovery

"How did we come to know this?"The CLIP initiative was launched based on insights from a survey aimed at identifying the key factors influencing a card’s selection as the primary payment method (PPM) at checkout.

In this phase I led the analysis of the survey results and NPS reports to pinpoint critical areas for improvement in the CLIP program. This analysis revealed several key findings:

- Higher credit limits are the primary driver for customers to use a card as their "first payment option."

- Interest-free installments (MSI) are especially appealing to lower-income segments.

- Competition: Nu currently dominates the PPM share among higher-income customers.

- Payment Priority: Cards selected as the PPM are 35% more likely to be paid off first, highlighting their significance in user financial behavior.

These findings emphasize the importance of offering higher credit limits to establish a card as the primary payment method and prioritize repayment. Furthermore, NPS feedback revealed a strong demand for increased credit limits via CLIP and the inclusion of MSI options. These insights became essential in shaping strategies to enhance user satisfaction and engagement.

Additionally, customer feedback from the NPS Report shows a clear demand for higher credit limits through CLIP and the option to pay in installments (MSI). These insights are key to improving customer satisfaction and engagement.

‧ ‧ ‧

PROBLEM

Setting the problem

To clearly define the challenges, I facilitated a problem-framing workshop (with stakeholders) using How Might We (HMW) questions to encourage creative thinking and solution-oriented approaches. By framing problems with HMW questions, the team fostered a sense of optimism and collaboration, which helped generate a variety of innovative solutions.

The primary goal identified was to improve user engagement and satisfaction with the CLIP experience, driving long-term growth and loyalty. This required addressing technical and design issues while ensuring user needs and expectations were met.

The central question we addressed was:

“How might we improve user engagement and satisfaction with the CLIP (Credit Line Increase Policy) experience to drive long-term growth and loyalty within our customer base?”

Defining metrics:

To evaluate the success of the CLIP feature implementation, I facilitaded a session with our stakeholders (tech, product, fraud, sales, legal, etc) to establish measurable Key Results (KRs) and metrics based on detractor feedback. These included:

These metrics served as a framework to track the feature’s performance and guide future improvements in user satisfaction and engagement.

To clearly define the challenges, I facilitated a problem-framing workshop (with stakeholders) using How Might We (HMW) questions to encourage creative thinking and solution-oriented approaches. By framing problems with HMW questions, the team fostered a sense of optimism and collaboration, which helped generate a variety of innovative solutions.

The primary goal identified was to improve user engagement and satisfaction with the CLIP experience, driving long-term growth and loyalty. This required addressing technical and design issues while ensuring user needs and expectations were met.

The central question we addressed was:

“How might we improve user engagement and satisfaction with the CLIP (Credit Line Increase Policy) experience to drive long-term growth and loyalty within our customer base?”

Defining metrics:

To evaluate the success of the CLIP feature implementation, I facilitaded a session with our stakeholders (tech, product, fraud, sales, legal, etc) to establish measurable Key Results (KRs) and metrics based on detractor feedback. These included:

- CLIP Adoption Rate: Percentage of eligible users who activate and use the CLIP feature at least once, with a goal of 70% adoption in the first quarter.

- CLIP Utilization Rate: How much of the available CLIP limit users are utilizing, targeting at least 50% utilization.

- CLIP Satisfaction Score: User satisfaction with the CLIP feature, aiming for an average score of 4 out of 5.

- CLIP Activation Time: Average time for users to activate CLIP after becoming eligible, with a goal of reducing this to under 3 days.

- CLIP Impact on Detractor Reasons: Reduction in user complaints about not having access to CLIP, targeting a 20% decrease within six months.

These metrics served as a framework to track the feature’s performance and guide future improvements in user satisfaction and engagement.

‧ ‧ ‧

IDEAS

Ideation workshop

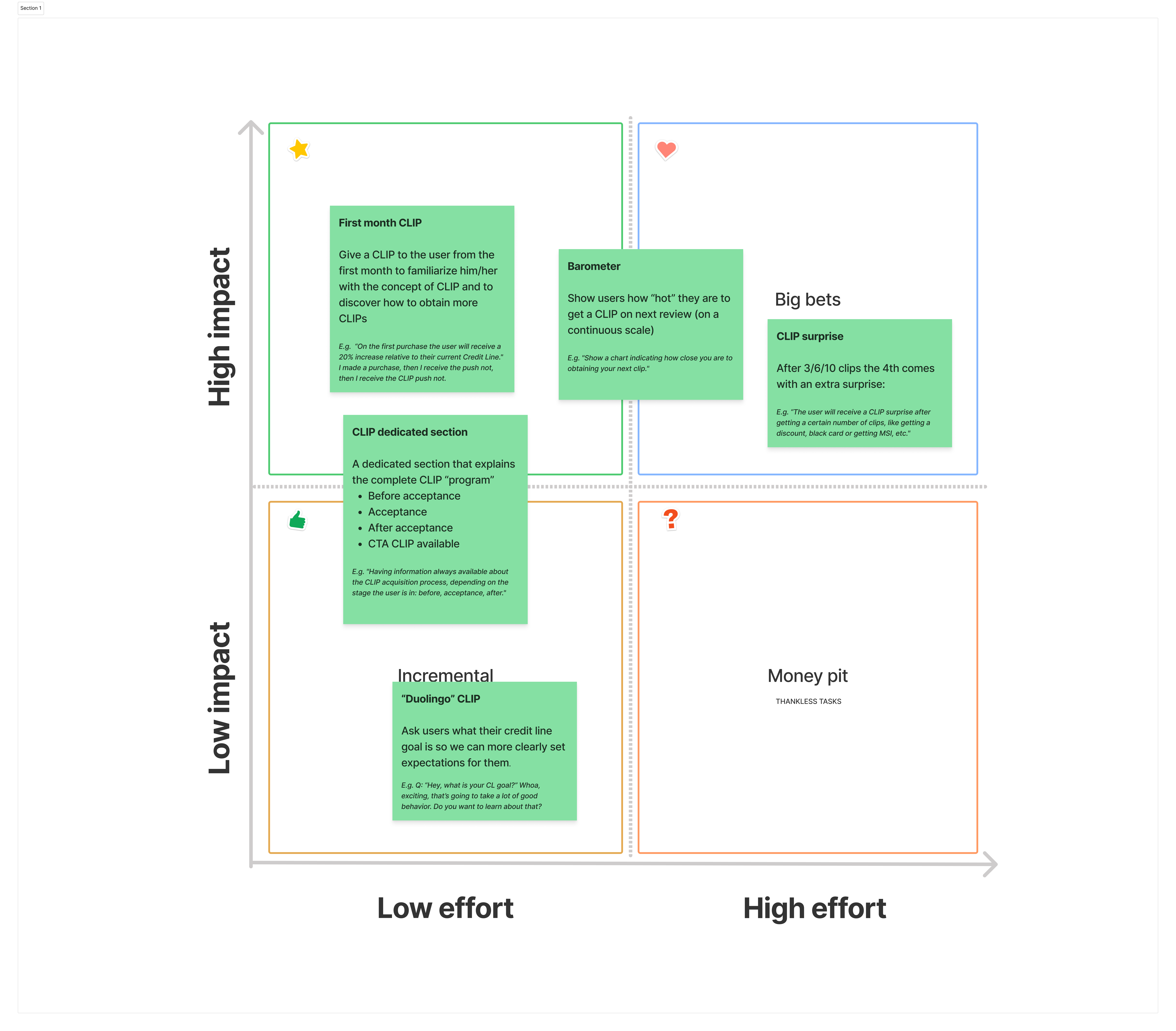

To address the identified problem, I designed and moderated a brainstorming session with a multidisciplinary team comprising members from product, design, engineering, and customer service. This structured workshop allowed all participants to contribute ideas and collaborate on potential solutions. My role included planning the session, setting the agenda, and ensuring active participation from all team members.

Key outcomes

These solutions were identified as the most impactful and feasible for improving the CLIP experience. The ideation workshop enabled the team to generate creative ideas and select those best suited to addressing the challenges.

To address the identified problem, I designed and moderated a brainstorming session with a multidisciplinary team comprising members from product, design, engineering, and customer service. This structured workshop allowed all participants to contribute ideas and collaborate on potential solutions. My role included planning the session, setting the agenda, and ensuring active participation from all team members.

Key outcomes

- Implementation of a CLIP "Heat" Meter: It was decided to develop a visual meter within the app indicating users' likelihood of receiving a credit increase at the next review. This feature would provide transparency and motivation to improve financial behavior.

- Creation of a CLIP Educational Section: It was agreed to develop a dedicated section in the app explaining the CLIP program in detail, including eligibility criteria and steps to obtain a credit increase. This would help users better understand the process and increase their engagement.

- Integration of CLIP Rewards: It was proposed to offer rewards and additional benefits to users who achieved milestones in their participation in the CLIP program, such as interest rate discounts or financial incentives. This would incentivize participation and foster customer loyalty.

These solutions were identified as the most impactful and feasible for improving the CLIP experience. The ideation workshop enabled the team to generate creative ideas and select those best suited to addressing the challenges.

MVP:

I contributed directly to defining the features of the Minimum Viable Product (MVP). These features were designed to provide immediate value, improve transparency, and encourage user engagement with the CLIP program.

These features aim to provide immediate value, clear understanding, and motivation for users to engage with the CLIP program and achieve their financial goals.

I contributed directly to defining the features of the Minimum Viable Product (MVP). These features were designed to provide immediate value, improve transparency, and encourage user engagement with the CLIP program.

- Barometer for CLIP Eligibility: A visual scale shows users their likelihood of receiving a future CLIP, motivating better financial behavior.

- Dedicated CLIP Section: A section within the app explains the CLIP program in detail, guiding users through each stage of the process.

- CLIP on First Purchase: Users receive an immediate credit line increase (e.g., 20%) after their first purchase, giving them a tangible experience of CLIP.

- CLIP Surprise: After a set number of CLIPs (e.g., 3, 6, or 10), users receive surprise bonuses such as discounts, upgraded status, or perks like installment plans (MSI).

These features aim to provide immediate value, clear understanding, and motivation for users to engage with the CLIP program and achieve their financial goals.

‧ ‧ ‧

TESTING

Usability testing

To evaluate the usability and user experience of the CLIP feature in the mobile app, I planned and moderated a series of usability testing sessions. These sessions involved 10 participants from our target audience, including regular credit users and those interested in increasing their credit line.

Methodology:

Participants performed specific tasks related to the CLIP feature while thinking aloud, and their actions and comments were recorded for analysis.

Key Findings:

Recommended Actions:

To evaluate the usability and user experience of the CLIP feature in the mobile app, I planned and moderated a series of usability testing sessions. These sessions involved 10 participants from our target audience, including regular credit users and those interested in increasing their credit line.

Methodology:

Participants performed specific tasks related to the CLIP feature while thinking aloud, and their actions and comments were recorded for analysis.

Key Findings:

- Discovery Issues: Participants had difficulty finding the CLIP feature, suggesting it needs better placement or highlighting.

- Confusion about Requirements: Some users didn’t fully understand the eligibility criteria, indicating a need for clearer communication.

- Process Complexity: The CLIP application process was seen as confusing by some, calling for simplification.

- Visual Feedback: Users wanted immediate visual feedback, such as confirmation or progress tracking after applying for CLIP.

- Information Enhancements: Participants requested more information about CLIP benefits, terms, interest rates, and its impact on credit history.

Recommended Actions:

- Relocate and better highlight the CLIP feature for easier discovery.

- Clearly communicate eligibility requirements in the user interface.

-

Simplify and streamline the CLIP application process.

-

Incorporate visual feedback to confirm application and track progress.

- Provide transparent information on CLIP benefits, terms, and credit impact.

‧ ‧ ‧

THE SOLUTION

Desing solution

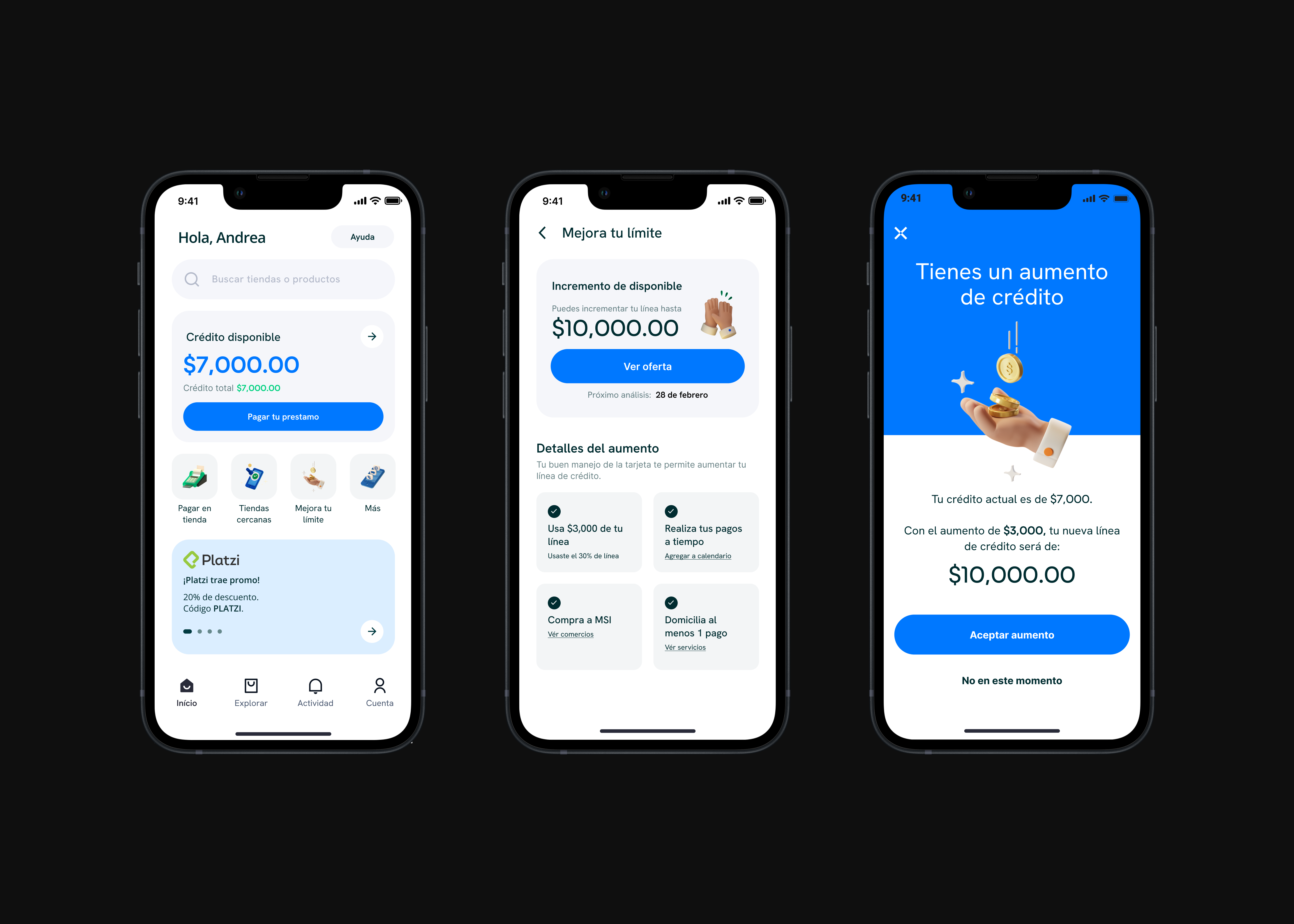

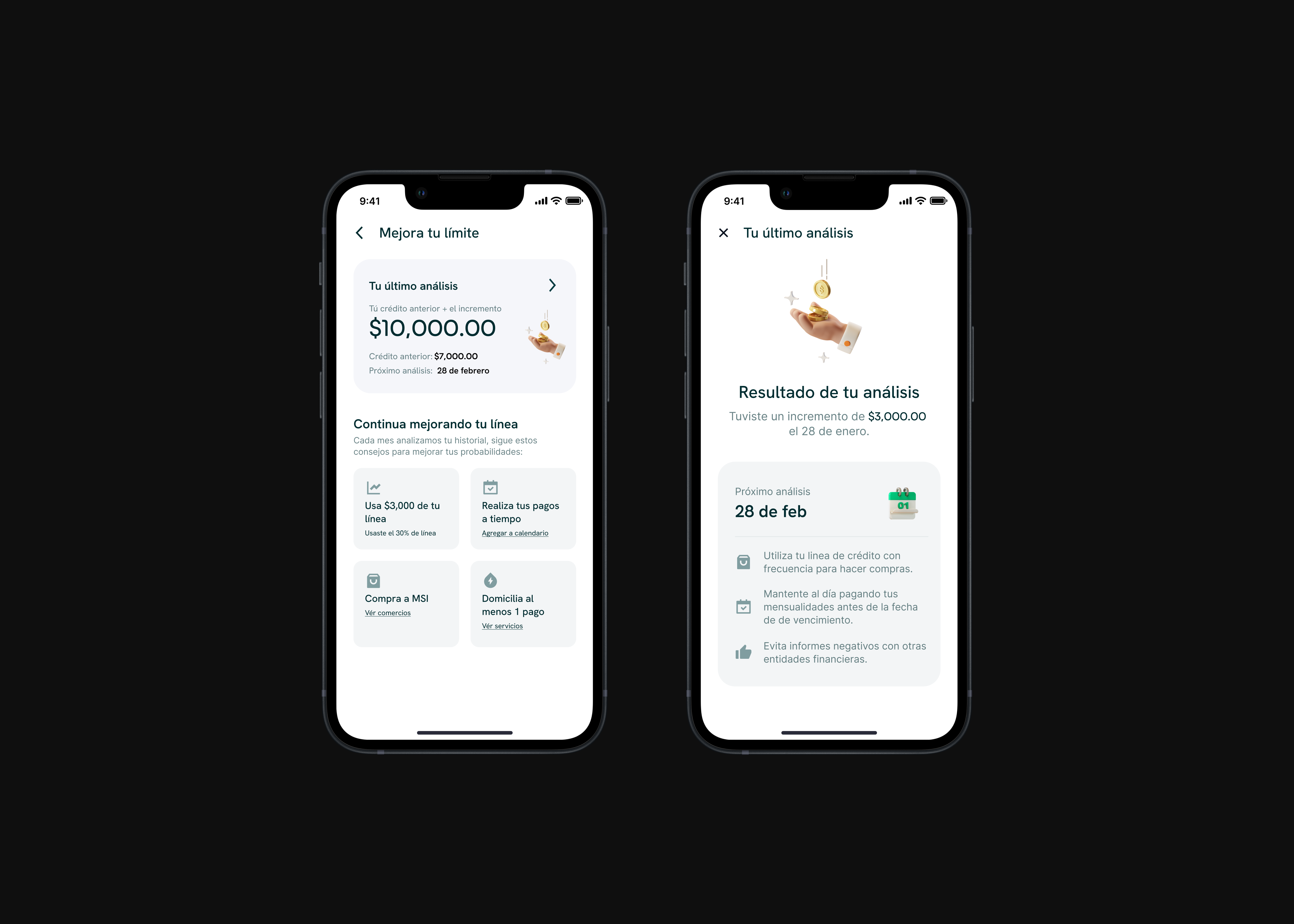

I played a key role in the redesign of the CLIP solution, ensuring it was centered on user needs while addressing the challenges identified during testing. My contributions focused on improving visibility, streamlining processes, and providing personalized recommendations to enhance the overall user experience.

Real-time feedback and continuous improvement ensure a seamless user experience, driving engagement and satisfaction while supporting long-term growth.

I played a key role in the redesign of the CLIP solution, ensuring it was centered on user needs while addressing the challenges identified during testing. My contributions focused on improving visibility, streamlining processes, and providing personalized recommendations to enhance the overall user experience.

Real-time feedback and continuous improvement ensure a seamless user experience, driving engagement and satisfaction while supporting long-term growth.

‧ ‧ ‧

BUSINESS AND CUSTOMER IMPACT

Measure ︎︎︎ learn ︎︎︎ Iterate

Next steps:

Next steps:

- Metrics Review: We will review the key metrics, including adoption rates, utilization rates, satisfaction scores, and detractor reasons, to evaluate the feature's performance.

- Usage Data Analysis: We will analyze user behavior data to understand how customers interact with the CLIP feature and identify any patterns or opportunities for improvement.

- Feedback Collection: User feedback will be gathered through surveys and direct interaction to capture qualitative insights into their experience with the feature.

Thanks

‧ ‧ ‧